With the financial year at a near close, the countdown is on…..

Take advantage of the Federal Governments incentive for small businesses and claim an instant 100% tax deduction on assets purchased for your business before June 30 2017.

If you qualify as a small business in the 2016-2017 financial year, you can buy Art, Sculpture and Fine Furniture assets for your place of business up to the value of $20,000 for each item.

Talk to your tax professional about how the instant tax write-off can apply to your business.

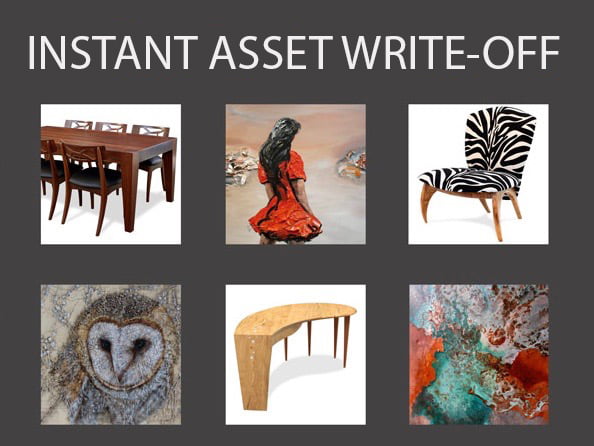

An iconic piece of designer furniture or an exceptional piece of artwork helps a business stand out and be remembered. Choosing the right piece can make a bold statement bringing enjoyment to your staff and clients, at the same time prove to be an asset that will appreciate in value over time.

JahRoc Galleries have been helping Australian Small Business operators choose collectable art and furniture for nearly 30 years and can offer sound advice when choosing the right piece of art to add to their investment portfolio.

The coundown is on….

Information from the ATO website…

Simpler depreciation rules – instant asset write-off

If you are a small business, you can immediately deduct the business portion of most assets that cost less than $20,000 each if they were purchased:

- from 1 July 2016 to 30 June 2017, and your turnover is less than $10 million

- from 7.30pm on 12 May 2015 to 30 June 2016, and your turnover is less than $2 million.

This deduction can be used for each asset that costs less than $20,000, whether new or second-hand. You claim the deduction through your tax return, in the year the asset was first used or installed ready for use.

Please note: In the Budget 2017, the Government announced an extension of the $20,000 instant asset write-off threshold to 30 June 2018 – the threshold currently reduces to $1,000 from 1 July 2017. For more information about the proposed change see, Extending the immediate deductibility threshold for small business.

See Also:

SIMPLIFIED DEPRECIATION – RULES

WHAT’S NEW FOR SMALL BUSINESSES

A Taste Of What To buy For Your Office….

Shop Latest Arrivals Artworks

Shop ARTWORK

Shop ALL FINE FURNITURE

Shop FINE FURNITURE —————